YouTube is the popular Streaming platform used to look at Movies, Television Shows, Sports Videos, Cartoons, Anime Movies and Greater videos. Downloading YouTube Videos for your device is one of the best ways to shop a few net records. Despite the fact that ios devices are greater secured, downloading or saving YouTube Videos for your iPhone/iPad isn’t that tough.

In this Article, we will display a way to download/store YouTube Videos on iOS Devices.

How to download YouTube Videos on iPhone/iPad using YouTube Premium?

YouTube top rate is the best and criminal manner to download YouTube Videos on iPhone, iPad and android Devices. The introduced gain of purchasing the YouTube top rate is that you may movement Videos on YouTube with none commercial interruptions. The premium service of YouTube expenses $12/month with a one-month free trial length for brand spanking new customers.You can purchase the premium service of YouTube right from the YouTube app.

1: Launch the YouTube app.

2: Locate the Video that you want to download.

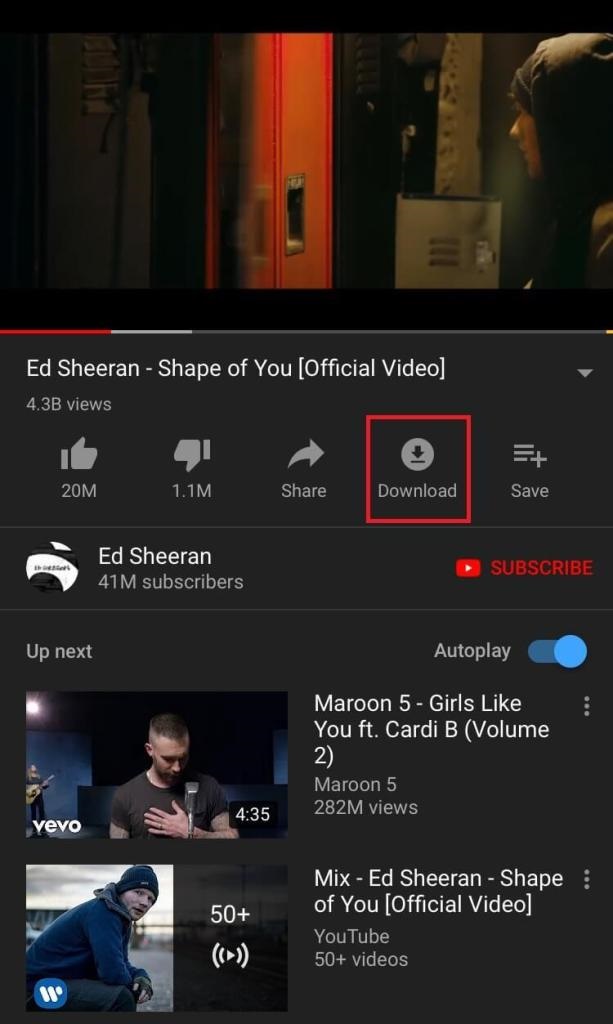

3: Tap the Download icon located next to the share icon.

4: Select the video resolution (720p or 1080p) that you want and tap OK.

The video will be downloaded on your device. You can access the downloaded video under the library section on the YouTube app.

How to download YouTube Videos on iPhone/iPad using Shortcuts?

1: Download and install Shortcuts app on your iPhone/iPad.

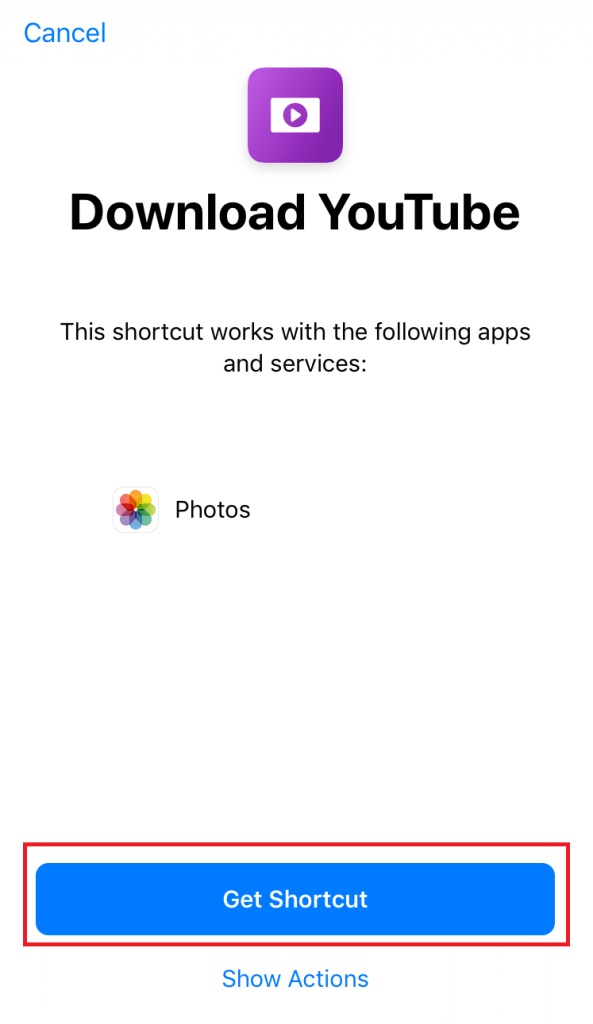

2: Visit this iCloud page, and tap Get Shortcut.

3: Now, navigate to the YouTube videos which you want to download.

4: Tap the Share icon located below the video title.

5: Swipe left, and tap the More button.

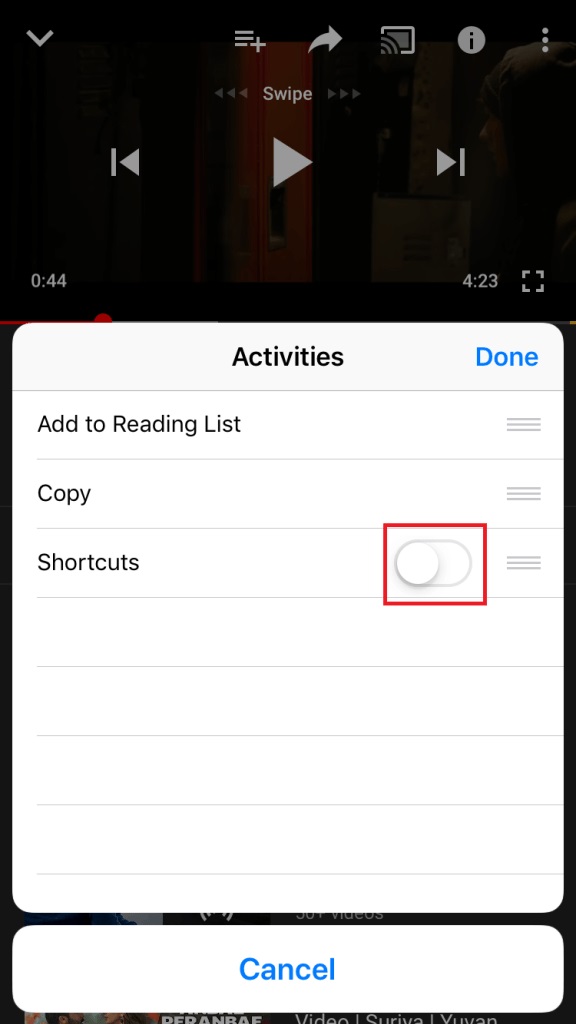

6: Turn on the Shortcuts menu.

7: Again click the Share icon located the video title.

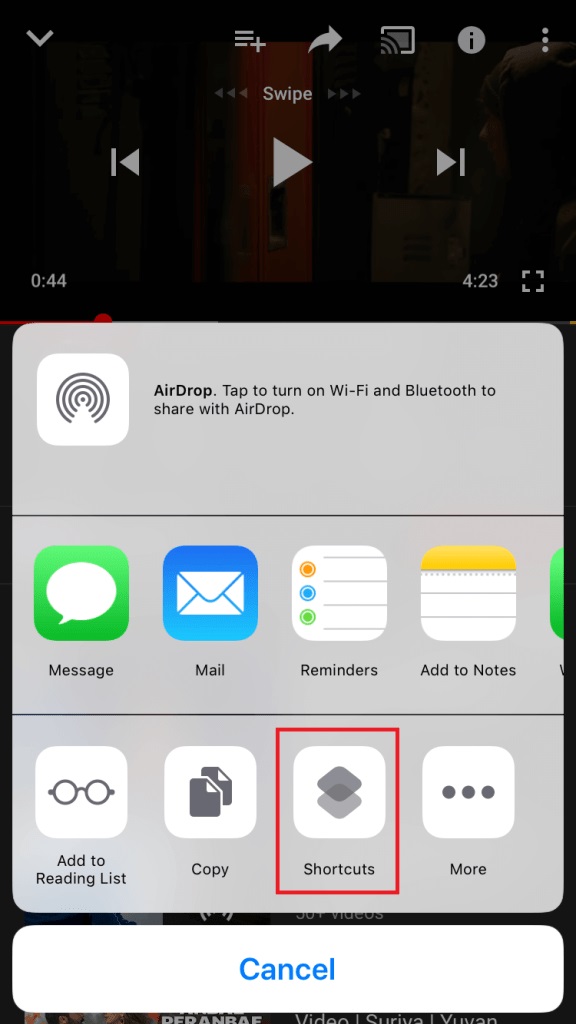

8: Now, click the Shortcuts icon located next to the copy menu.

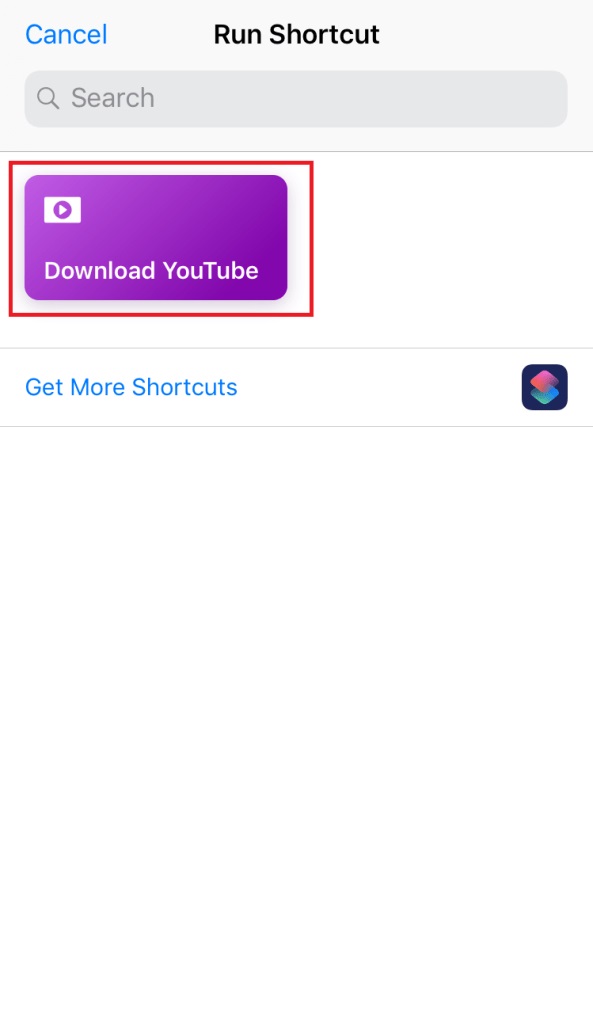

9: Tap Download YouTube.

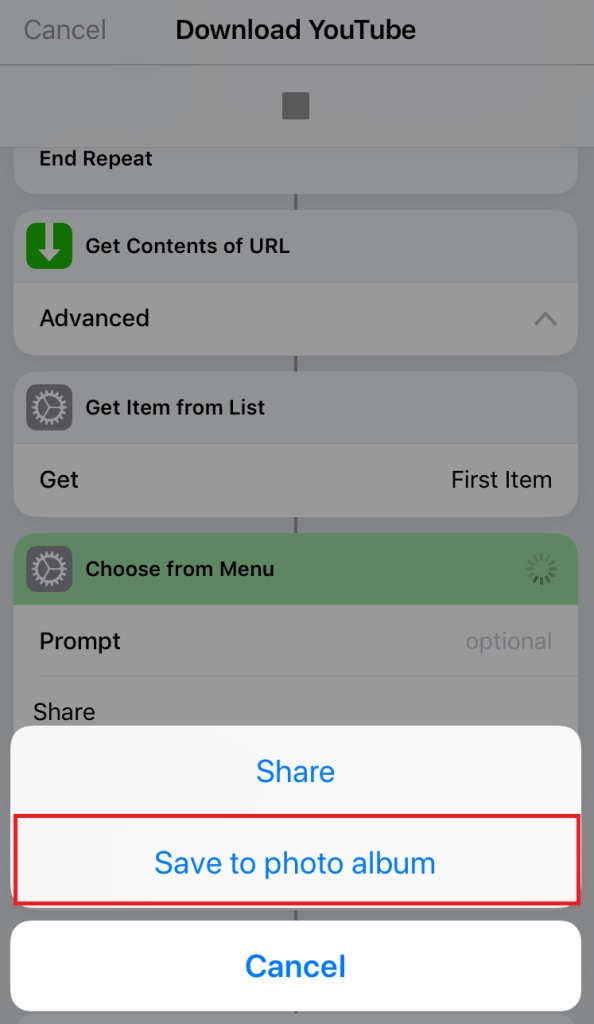

10: Click Save to Photo Album on the pop-up that appeared on the screen.

11: Within a few minutes, the videos will be Saved in the Photos app.

How to Download a YouTube Videos with 4K Video Downloader

4K Video Downloader is a versatile YouTube Downloader for Windows, Linux and macOS that allows you to download YouTube to Mp3, Mp4 Videos, playlists, and whole channels from YouTube, Facebook, Vimeo, and other video sites in any quality you want.

4K Video YouTube Downloader can additionally download annotations and subtitles in .srt format or embed ones for a single video or entire playlist in one click. You can transfer the downloaded videos directly to your iTunes library and enjoy them on your iPhone, iPod, or iPad anywhere you go.

Download YouTube Videos with 4K Video Downloader

1. To get started with this excellent YouTube downloader, head over to its official website.

2. Click the “Get 4K Video Downloader” link.

3. Install 4K Video Downloader as you would any other application.

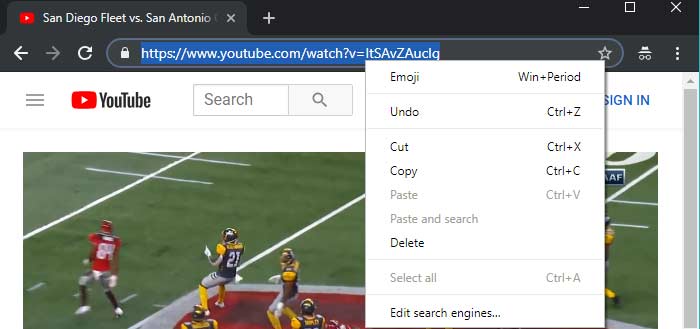

4. Go to YouTube, open the video you want to download, and copy its link from the browser.

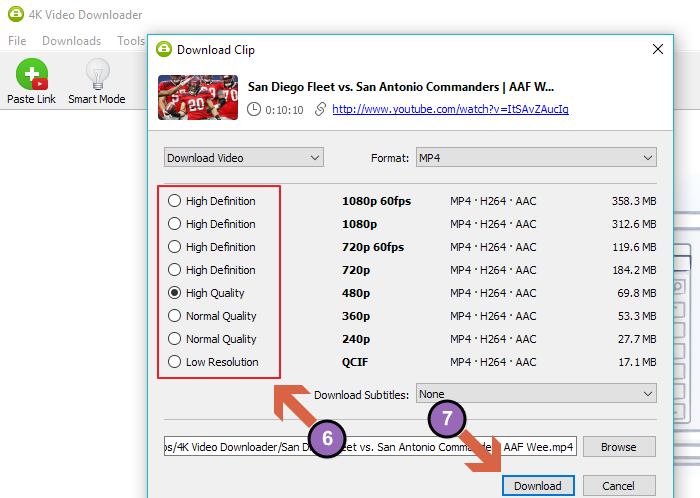

5. Press “Paste Link” button in 4K Video Downloader.

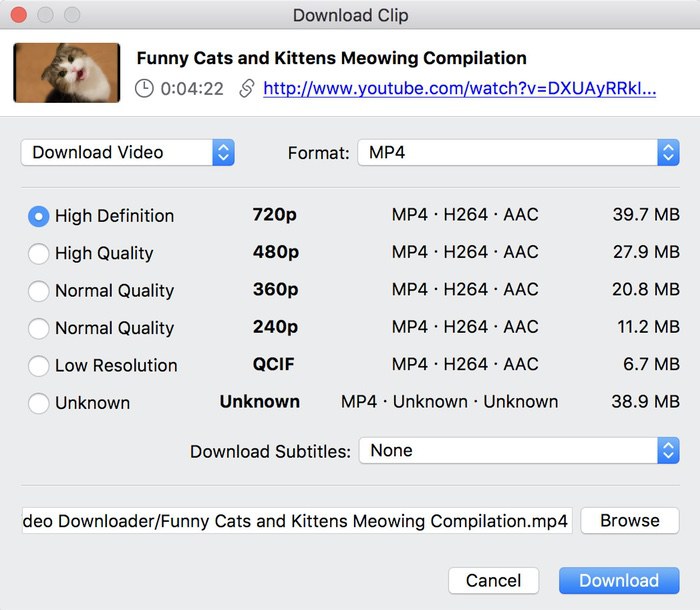

6. Select the desired video quality, format, and download location.

7. Press the “Download” button.

8. Wait for your video to download.

Final Words :

These are the two Methods Available to Download YouTube videos on your iOS device. Now, you can Save some internet data by Accessing your favorite videos in the offline mode.

Add Comment